- Airwallex’s integration with Xero enables its small-to-medium business (SMB) customers to reconcile their domestic and international payments seamlessly

- In addition to saving money through Airwallex’s bank-beating foreign exchange rates, the integration with Xero will allow SMBs to save time by ensuring accuracy in their financial reporting.

HONG KONG, March 10, 2020 /PRNewswire/ — Global fintech leader Airwallex today announced an integration with Xero, the global small business platform – to help Airwallex’s small-to-medium business (SMB) customers seamlessly reconcile their domestic and international payments, saving time and ensuring accuracy. This integration is part of the company’s ongoing commitment to enable SMBs’ growth in an increasingly borderless world.

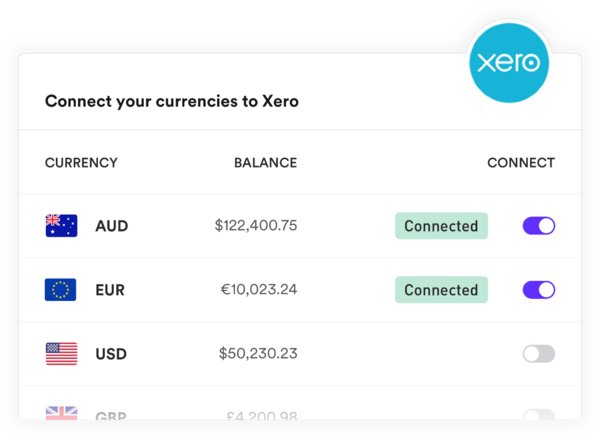

From today, Airwallex’s integration with Xero will enable SMBs to connect their multi-currency financial transactions in Airwallex to Xero. This will allow Airwallex customers to view a daily update of their transactions* through their Xero bank feeds, simplifying and speeding up the reconciliation process to free SMBs from labour-intensive manual processes so they can instead focus on driving business growth.

SMBs will also have full visibility of their Airwallex funds within Xero’s interface to gauge their business’ financial health and position at any given time.

“Small businesses do not have the time or resources to manage multiple technology solutions that often operate in silos – they need solutions to work and integrate with each other seamlessly. This is even more imperative when it concerns their multi-currency financial reporting as there is no room for errors,” said Jack Zhang, CEO and co-founder, Airwallex.

“An integration with Xero is one of the most requested integrations from our customers. We have been listening and are delighted to be able to offer this to our Australian customers from today, with a wider international rollout planned across 2020. This is the start of a series of capabilities that we plan to introduce with Xero to improve the way small businesses manage their finances across platforms,” Jack Zhang added.

Ian Boyd, financial industry director at Xero, said, “As more small businesses enter overseas markets, it’s important that their multi-currency payments flow seamlessly in Xero and are automatically reconciled. This integration with Airwallex will ensure our mutual customers spend less time on administrative tasks and more on what’s important to them – running their business.”

Airwallex currently offers SMBs the ability to access interbank foreign exchange rates on international payments and transactions. SMBs can also easily open accounts in the US, UK and EU on Airwallex, allowing them to break down the barriers of achieving international growth.

Following Airwallex’s recent launch of the Airwallex Borderless Card in partnership with Visa, along with today’s Xero integration, the company now provides an alternative business account for modern businesses that want to operate and bank online.

The integration is currently live in Australia and will become available in the UK and HK later this year.

*Xero Premium account users will be able to connect multi-currencies. Xero Starter and Standard account users will be able to connect a single domestic currency.

NOTES TO MEDIA

For further information

If you have any questions or would like to request further information, please contact Kristen Wang, Airwallex at kristen.wang@airwallex.com or Jessica Brophy, Xero at jess.brophy@xero.com.

About Airwallex

Airwallex was founded in Melbourne, Australia in 2015 with a simple goal – to push the boundaries of global financial services capabilities in an increasingly borderless world. Airwallex has since secured over $200 million USD in external funding, supported by top-tier investors including DST Global, Sequoia Capital China, Tencent, Hillhouse Capital, Gobi Partners, Horizons Ventures and Square Peg Capital. The company’s core strength lies in its proprietary tech-driven infrastructure to enable low-cost, high-speed and transparent international collections and payments (accessible via API), and its SME business account which helps businesses grow both domestically and internationally. Airwallex has been on an expansion journey and has now established ten international offices across Hong Kong, Melbourne, Shanghai, Shenzhen, Beijing, Singapore, London, San Francisco, Tokyo and Bangalore. www.airwallex.com

About Xero

Born in the cloud, Xero is a beautiful, easy-to-use platform for small businesses and their advisors around the world. Xero provides its 2+ million subscribers with connections to a thriving ecosystem of 800+ third-party apps and 200+ connections to banks and financial service providers. On the inaugural 2018 Financial Times FT1000 High-Growth Companies Asia Pacific list, Xero was the fastest growing tech company in the $200+ million segment. Xero won ‘Accountancy Software Provider of the Year’ at the British Business Awards in 2019, and was rated by Canstar Blue as the best accounting software in Australia from 2015-2018 and in New Zealand in 2019.

Photo – https://photos.prnasia.com/prnh/20200309/2744086-1?lang=0