Version: CN

CCRIS and CTOS. These terms may be daunting to you, especially when you’re about to take out a loan.

Plus, what do credit scores mean, and how do you get a good score?

In this article, we’ll explore what they are and why they matter, especially for future homeowners.

Let’s dive into making these financial concepts simple and clear!

What is CCRIS, and what is CTOS?

In Malaysia, the primary credit reports are obtained from CCRIS and the CTOS.

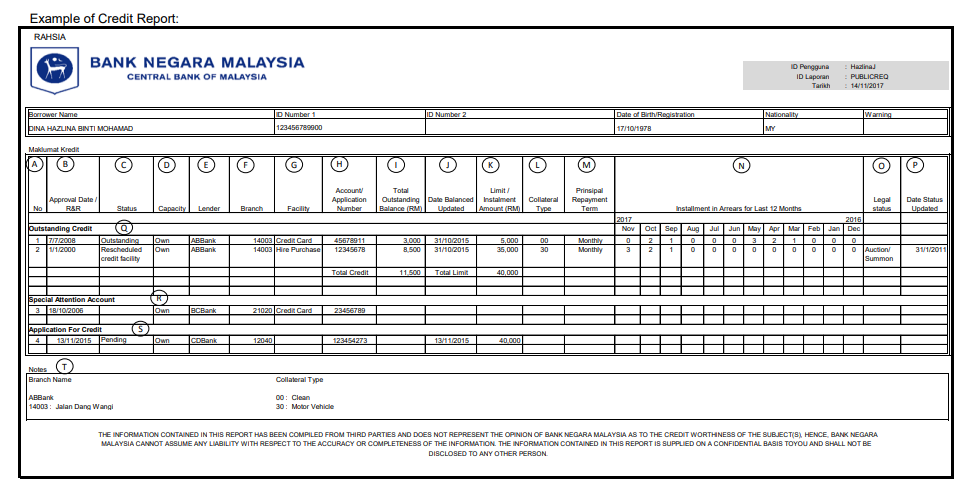

CCRIS, managed by Bank Negara Malaysia, is a digital database containing an individual’s credit information, including any outstanding loan amounts from the past 12 months.

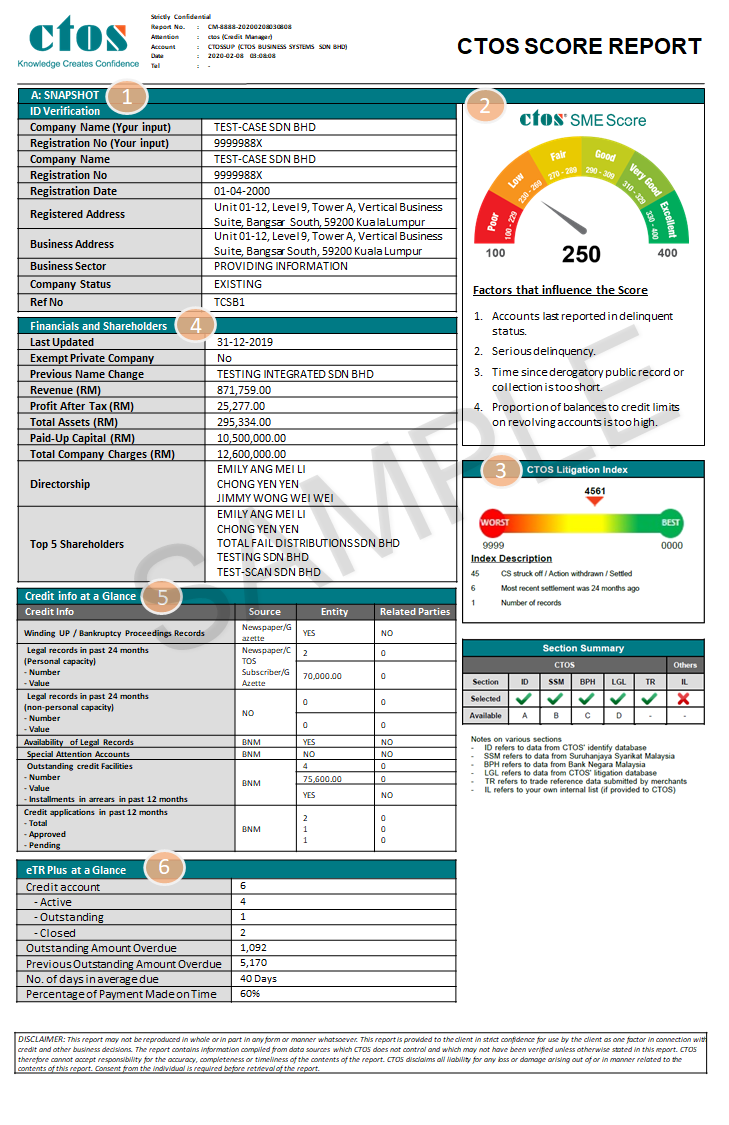

CTOS, operated by a private company, maintains the complete credit history of an individual or company, unlike the 12-month duration of a CCRIS report.

CCRIS (Central Credit Reference Information System)

Operated by Bank Negara Malaysia (BNM), CCRIS shows you your credit history over the past 12 months.

It’s not just about your timely repayments; it’s about your discipline in managing various financial responsibilities, including personal loans, mortgages, and credit cards.

Sample CCRIS Report (Courtesy Bank Negara Malaysia)

Key Points:

- Provides a factual report on your credit payment history.

- Records all your credit applications, approved or not.

- Free of charge and accessible via BNM or eCCRIS.

How to obtain your CCRIS report?

You can get a free copy of your CCRIS report from Bank Negara by visiting their main office or branches in Kuala Lumpur, bringing your MyKad and identity documents.

Alternatively, you can download the CCRIS request form online, fill it out, and submit it with supporting documents through mail, fax, or email.

CTOS (Credit Tip-Off Service)

CTOS is a private agency producing credit reports that include your credit history, business interests, legal matters in addition to the information found in CCRIS.

Sample CTOS Report (Source: CTOS Credit)

Key Points:

- Produces a credit score ranging from 300 to 850.

- Comprehensive credit reports that include legal history and business affiliations.

- Basic report is free, a more detailed MyCTOS Score Report is available for RM26.50

How to obtain your CTOS report?

After registering on the CTOS website or mobile app, individuals or companies in Malaysia can easily obtain their free and basic CTOS report online.

Differences between CCRIS and CTOS

While both CCRIS and CTOS provide credit reporting, understanding their differences is key in managing your credit health.

| Key Aspect | CCRIS | CTOS |

|---|---|---|

| Source of information | Gathers data from financial service providers. | Collects information from both financial institutions and public sources, including the Companies Commission of Malaysia and the National Registration Department. |

| Accessibility | Reports are accessible through BNM, requiring a visit to their office or via the eCCRIS online portal. | Reports are easily obtained online, with options for more detailed reports at a fee. |

| Credit scoring | Does not provide a credit score; it offers a credit report. | Provides a credit score, giving lenders an easy-to-understand assessment of your creditworthiness. |

How to download CCRIS & CTOS report in Malaysia?

Before applying for a home loan, it’s wise to check your credit score first by downloading the credit reports.

Here’s how:

- CCRIS: You can obtain your CCRIS report for free by visiting BNM’s Customer Service Centre or via the eCCRIS website. Learn more here!

- CTOS: Register on the CTOS website and choose from their range of products.

Is CCRIS and CTOS report free?

- CCRIS: Currently, the CCRIS Report is free of charge from Bank Negara Malaysia or obtained via eCCRIS.

- CTOS: They offer a basic report for free, with more detailed reports available for a fee (RM 25.90).

Why do banks need both my CCRIS and CTOS reports?

The reports you give to the banks for your home loan application should make them confident in your financial skills.

These reports influence your credit score, helping the bank see you as someone who consistently pays monthly dues and manages debts responsibly.

This increases the chances of getting your home loan approved.

What is a Credit Score?

In simple terms, your credit score in Malaysia is a reflection of your financial health.

It’s a score given by credit reporting agencies, primarily CCRIS and CTOS, based on your credit history, repayment behaviors, and existing debts.

This score plays a crucial role when you apply for any financial product, especially home loans.

Why Does Your Credit Score Matter?

When you’re ready to take the leap into homeownership, your credit score becomes your financial passport.

Financial institutions will check this score to determine your creditworthiness.

What’s a good and bad credit score?

High Credit Scores (generally 700 and above)

Reflect responsible credit management, leading to easier loan approvals, and possibly lower interest rates.

Low Credit Scores (below 700)

Might signal to lenders that you’re a risky borrower, potentially resulting in loan application rejections or higher interest rates.

Will PTPTN loan affect credit score?

In Malaysia, PTPTN loan repayment starts six months after the financing period ends. This gives borrowers time to find a job before beginning repayments. Making timely payments on your PTPTN student loan can enhance your credit history.

For instance, if you don’t pay back your PTPTN loan and it reflects on your CTOS or CCRIS report, it could lead to rejection of your car or housing loan application by the bank.

When the bank sees a history of not paying a previous loan, they may doubt your ability to repay a new one promptly.

So yes, the PTPTN loan can impact your credit score and affect the approval rate of future loans.

Tips To Improve Your Credit Score

Embarking on the path to homeownership means ensuring your credit score shines. Here are actionable steps to boost your credit health:

1. Pay on time

Consistently pay your loans and credit card bills on time.

2. Manage your credit usage

Try not to use more than 30-50% of your credit limit.

3. Don’t apply for too many loans

Multiple applications within a short period can raise red flags.

4. Check your reports properly

Review your credit reports for errors and have them corrected.

5. Build a credit history

Responsibly using a credit card or servicing a small loan can build a positive credit history if you’re starting from scratch.

Conclusion

Understanding your credit score is the first step towards responsible homeownership in Malaysia.

By maintaining good financial habits, monitoring your credit report, and understanding the role of CCRIS and CTOS, you’re investing in your financial future.

Taking the first step towards home investment can be tricky. But you don’t have to worry! Consult with one of our real estate professionals. Fill in the form below and we can help you!

[hubspot type=form portal=5699703 id=85ebae59-f425-419b-a59d-3531ad1df948]