Are we in a recession yet? With many uncertainties in the global macroeconomic outlook, let’s look at what Juwai IQI Chief Economist Shan Saeed says.

| Content |

The era of 1970 is bouncing back with more red flags

According to the September issue of The Economist, we are witnessing several warning signs, such as Russia’s war on Ukraine, the uneven recovery from the pandemic, a drought, high inflation, supply disruptions and enormous uncertainty about Europe’s economic future. Amid the confusion, there is broad agreement on one thing: a recession is coming.

Bank of America’s latest report indicates markets are under pressure from the hawkish stance of the FED, and investors are becoming cautious such as;

- As the USD soars, Asia currencies (ADXY) are now at COVID low and GFC low, and if the continued oil drop cannot ignite a bid for Asia oil importers (Yen, Won, Rupee), it will signal a global recession.

- The UK has become the leading indicator for H2 2022 inflation overshoot because of “short-term fiscal stimulus panic to appease electorates such as energy price caps/rebates, bailouts, nationalization, US student debt forgiveness, and UK tax cuts.

- Such bailouts have yet to arrive in Australia, however, when housing prices fell in August by the fastest rate in 30 years, even as consumer stocks in H1 correctly discounted the global house price correction in the next 12 months.

- The next shoe will be Canadian and Australian banks, and maybe Brazil will be next.

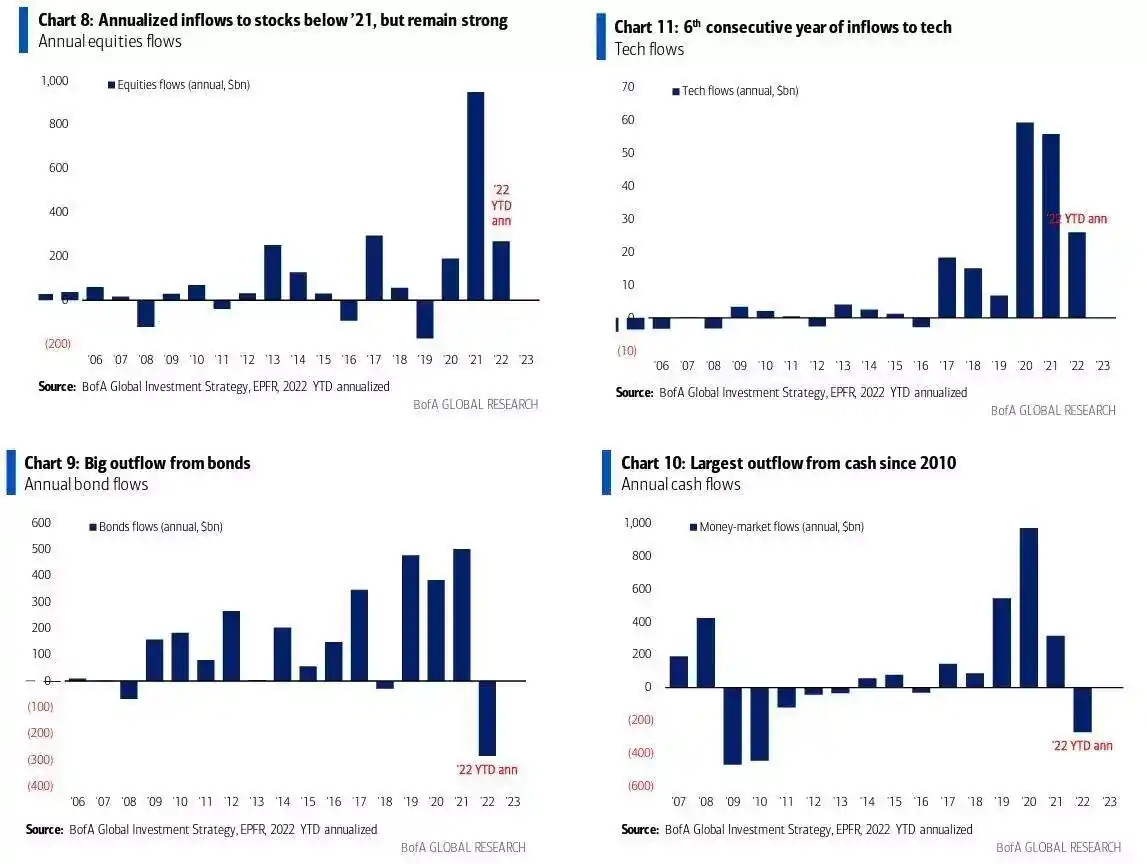

- Furthermore, the weekly flows are $4.8bn to cash, $0.9bn from gold, $4.2bn from bonds, and $9.4bn from stocks (the 4th largest of the year).

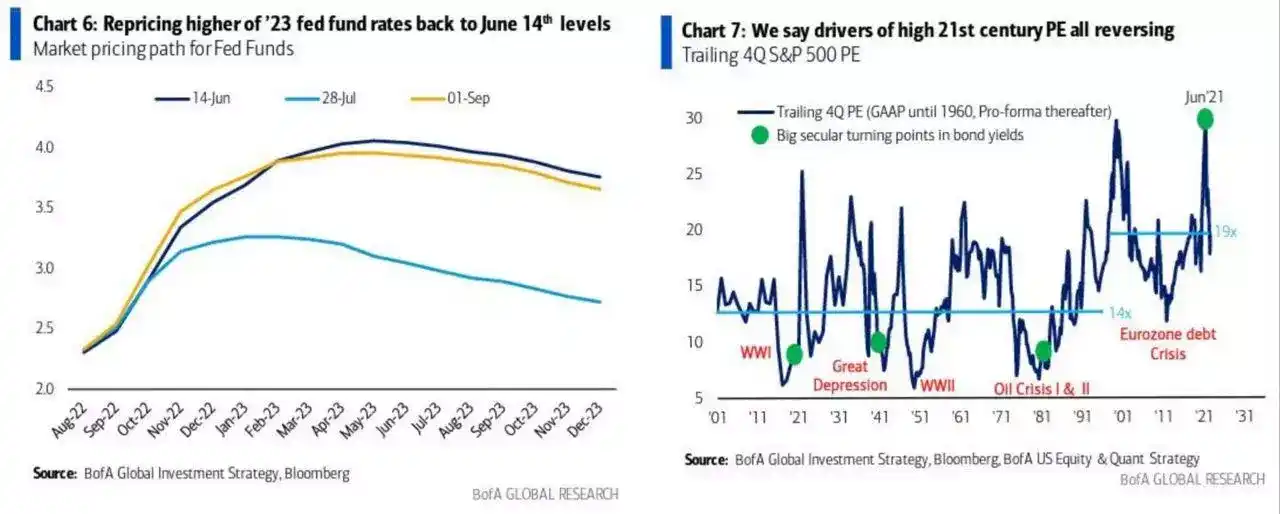

- Jackson Hole Symposium marked the end of the “Mission Accomplished” summer trade of peak CPI, with peak yields and FED cuts in 2023. Furthermore, the rally unwound because inflation is unlikely to fall below 4% by 2024; thus, 10-year yields and FED funds are likely to exceed 4% by 2024; note repricing higher of 2023 FED fund rates back to June 2022 levels – a complete roundtrip!

- Eventually, we find ourselves in a contradictory world where we are experiencing nominal growth, which continues to be boosted by inflation and fiscal stimulus. The past era of wealth accumulation has been replaced with a new era of “economic cancel culture” where economic pain elicits immediate public sector bailout, yet war is always inflationary.

CORRELATION WITH T-BILLS AND S&P500

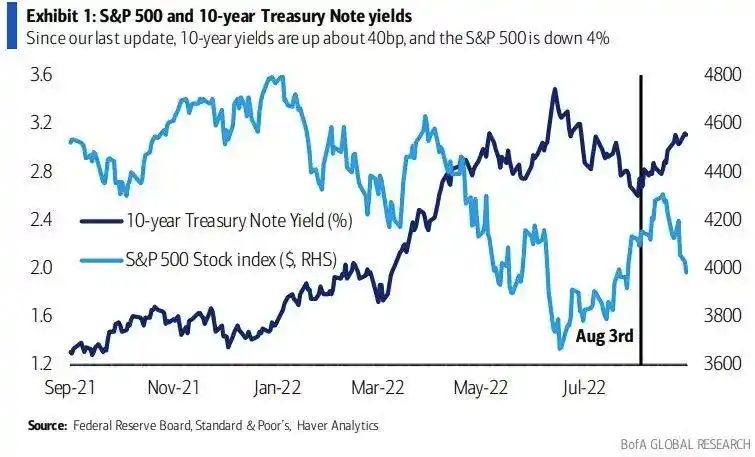

According to Bank of America’s latest report, the markets seem to have gotten the message and, in our view, are now closer to, but perhaps not fully aligned with, the FED’s message.

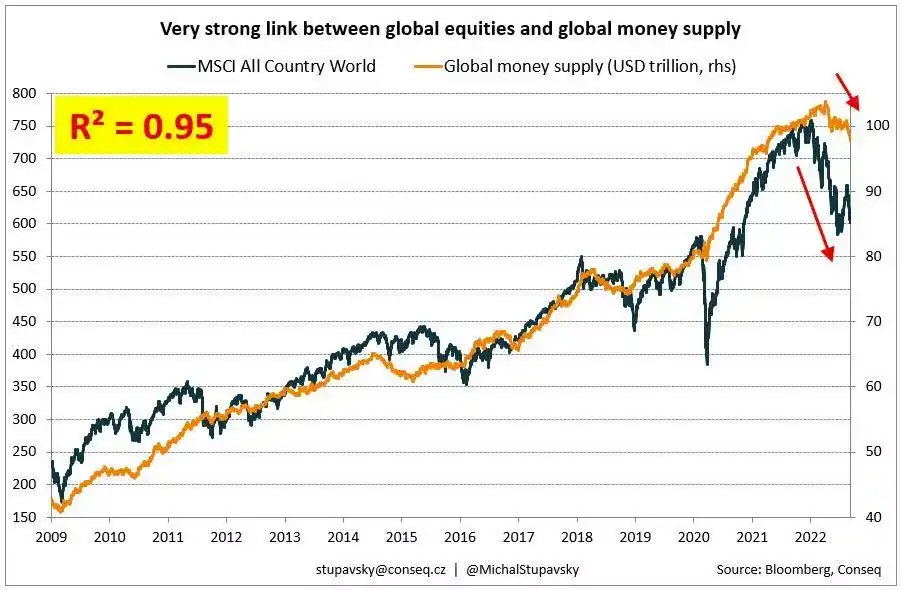

With the hawkish FED at the moment, which is draining global liquidity tremendously, the global stock markets are poised for further declines in the coming weeks, in my opinion.

CENTRAL BANK DIGITAL CURRENCY (CBDC)

The new paradigm shift in the financial market. Currently, around 105 countries are exploring central bank digital currencies (CBDC). They account for 95% of the global GDP collectively.

HOUSING MARKET IN UK – ON THE RISE

The pound fell from 4.5% in August to $1.16, the most significant monthly drop since October 2016. Sterling also fell by almost 3% against the Euro – yet the real estate market is on the upsurge. Furthermore, house prices in the UK rose at an annual rate of 10% last month, as a lack of supply supported valuations despite mortgage rates increasing and an intensifying cost of living crisis.

References: Financial Times, Bloomberg, Visual Capitalist

The article is written Shan Saeed, Chief Economist at Juwai IQI.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

Stay ahead of the economy news with IQI! Interested to invest and step up your game? Leave your interest below!

[hubspot type=form portal=5699703 id=2380afe3-ad4c-4cfa-9abf-d3947e377bf2]