Global economic fragilities are getting deeper into the financial markets. It is becoming clear that inflation will stay elevated and central banks will continue to hike interest rates until year-end. A total of 91 central banks have raised interest rates YTD to ward off inflation. However, inflation in advanced economies seems unmovable. There is a great schism in the inflationary outlook in advanced economies and ASIA. Central Banks’ hands are tied, and this chart from Ian Harnett elegantly visualizes the problem.

In the past, every time systemically essential banks (green) experienced a 20%+ equity drawdown, central banks (orange) had to step in, but they cannot and will not this time!

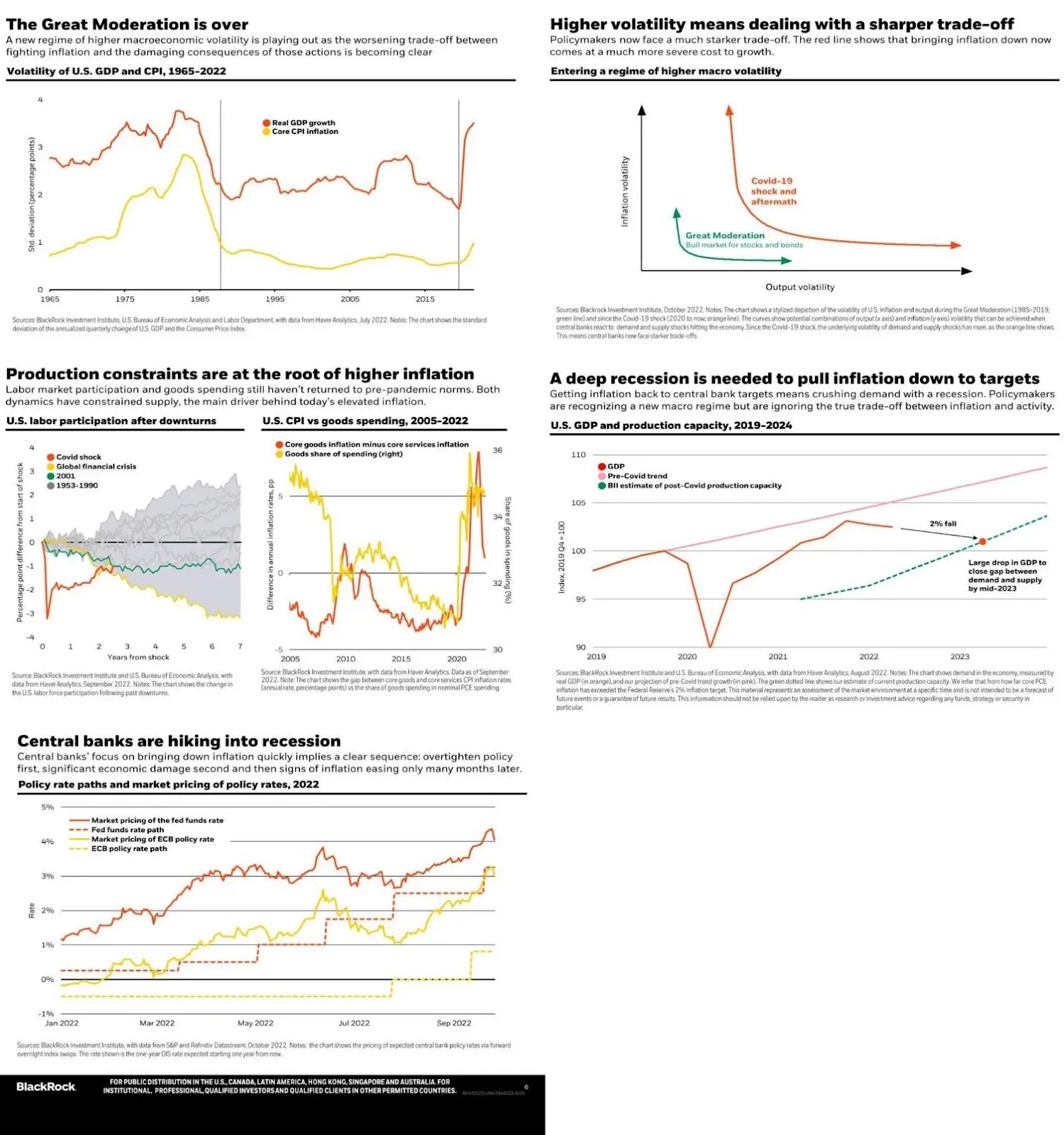

According to the latest report from BlackRock:

- The Great Moderation, the four-decade period of steady growth and inflation, is over

- Contracting activity and energy shocks signal recessions

- Inflation in developed economies is high and persistent

- Central banks are hiking into recession

- A deep recession is needed to pull inflation down to targets

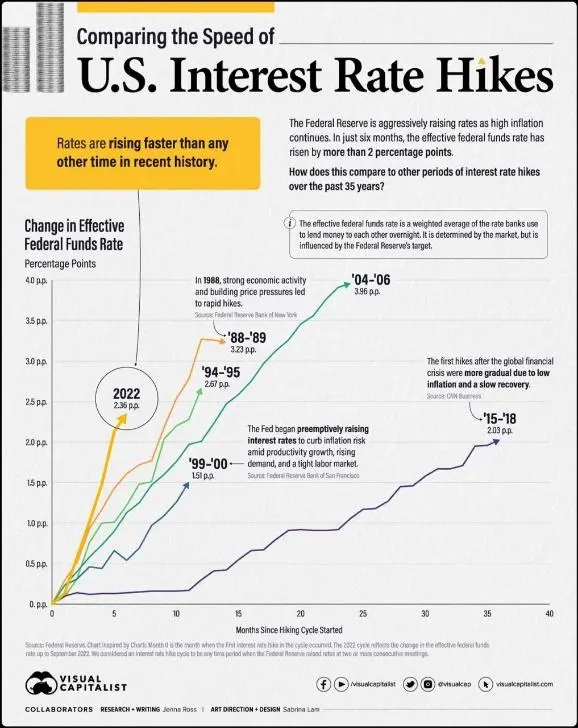

INTEREST RATES OUTLOOK FROM 1988-2022 IN THE USA

As U.S. inflation remains at multi-decade highs, the Federal Reserve has been aggressive with its interest rate hikes. Rates have risen more than two percentage points in just six months.

In this graphic inspired by a chart from Chartr, we compare the speed and severity of the current interest rate hikes to other periods of monetary tightening over the past 35 years.

The 2022 rate hike cycle is the fastest, reaching a 2.36 percentage point increase nearly twice as fast as the rate hike cycle of 88-89.

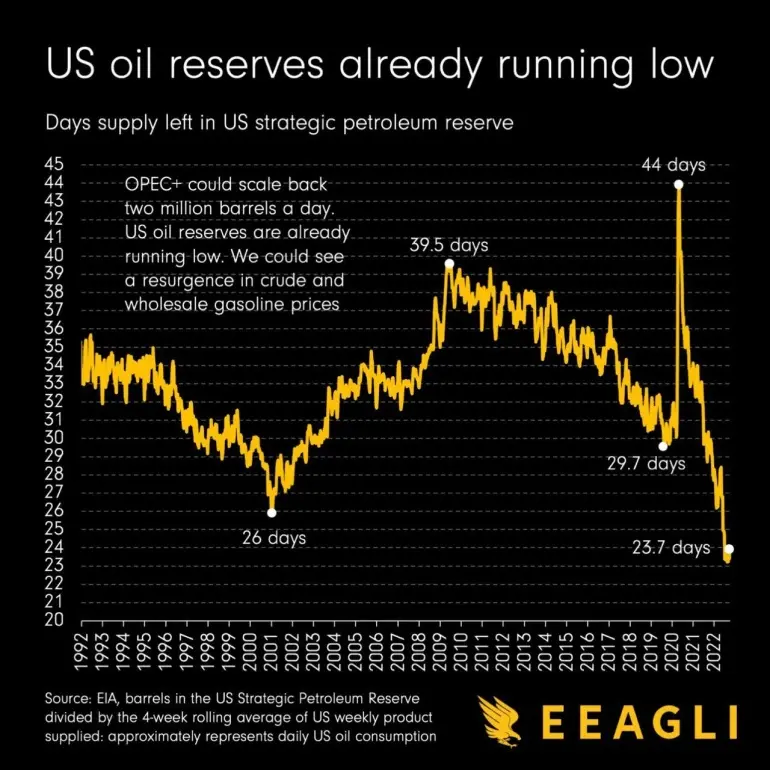

ENERGY MARKET OUTLOOK UPSURGE ON THE CARDS

The #energy crisis could get worse. So could the #costofliving crisis. OPEC+ has decided to cut two million barrels per day when there are just 24 days left of oil reserves in the U.S. Look at the chart below!

Here are some quick thoughts:

- The oil market will remain in a backward phase, i.e. spot will be higher than in the future.

- Saudi Arabia and Russia are calling shots in the energy market. We have been sharing since 2020.

- Oil prices meander around $110 to $150/barrel.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

The article is written Shan Saeed, Chief Economist at Juwai IQI.

Stay ahead of the economy news with IQI! Interested to invest and step up your game? Leave your interest below!

[hubspot type=form portal=5699703 id=85ebae59-f425-419b-a59d-3531ad1df948]