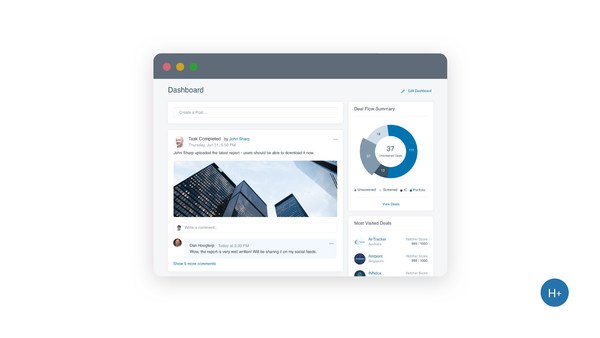

- Scalable, cloud-based platform enables accelerators, venture studios, family offices, corporate VCs, and venture fund managers to automate operations, create multi-level deal origination partnerships, and access thousands of deals annually, worldwide

- Developed at a cost of US$10m, the Hatcher+ VAAST™ platform incorporates advanced AI-based predictive analytics, impact scoring, and business process automation — and supports 18 languages and 50 currencies.

- The Hatcher+ VAAST™ platform, which incorporates over 20 leading SAAS-based technologies in addition to its proprietary code, has been used to quantify over 20,000 startups and 120 investments to date and is available free to qualifying accelerators, venture studios, family offices, and venture ecosystem partners.

SINGAPORE, Jan. 27, 2021 /PRNewswire/ — Hatcher+, a leading, next-generation, data-driven venture firm, has launched VAAST, the world’s first and most advanced Venture As A Service Technology Platform (VAAST™).

To view the Multimedia News Release, please click: https://www.prnasia.com/mnr/Hatcher_VAAST_202002.shtml

Unlike previous generations of stand-alone deal management platforms, VAAST™ has been designed from the ground up to enable quantitative analytics and big data to play a role alongside traditional, more subjective decision-making for the first time.

Through the platform, founders have easier access to capital, can share data between ecosystem partners and standardize the quantitative analysis of venture investments using advanced, AI-based predictive analytics (AI/ML). They can also manage investor communications and store and share data profiles, cap tables, pitch decks, investor documents, and KPI updates with multiple investors and stakeholders at the same time.

Through its inclusion of AI/ML, deal scouting capability and predictive scoring – technologies VAAST™ helps VCs identify potential startup opportunities based on an investor- defined mandate. Using the Deal Scout feature, users can scout startups using Natural Language Processing and use the Hatcher+ Opportunity Score to determine which startups best fit.

John Sharp, Founding Partner of Hatcher+, said, “Through our first traditional investment vehicle, Hatcher H1, we were reminded constantly of the qualitative and subjective nature of investing and how venture capital has lagged behind other asset classes in terms of technology adoption.”

“Since then, our mission is to de-risk, democratize and revolutionize the VC industry with new levels of intelligent automation, data sharing and analysis with Hatcher+ and VAAST™”.

To date, partnerships with leading accelerators and data vendors worldwide have enabled Hatcher+ to build a database of 600,000 transactions spanning 20 years to support its machine learning capabilities and expects to expand its portfolio and add up to 30,000 additional profiles annually by the end of 2021.

About Hatcher+

Headquartered in Singapore, Hatcher+ is a next-generation, data-driven, global venture firm. Since 2018, Hatcher+ has invested in 130 companies, bringing robust and consistent returns to investors as part of its H2 fund investment strategy. Last year alone, Hatcher+ analysed over 10,500 inbound deals on behalf of its LPs and 15 strategic co-investment partners. The company expects this number to rise to over 30,000 deals annually by the end of 2021.

Visit www.hatcher.com for more information.

Contact:

Darren Thang

Head of Marketing & Communications

+65-9699-1839

darren@hatcher.com