Version: CN

Do you want to get rich from the investment of your salary? In this era of soaring prices, only by the proper investment and utilizing your income safely can outperform inflation. No matter what your income is, you can save money if you follow some thoughtful steps.

Let’s take a look at what types of investments are worth considering in Malaysia!

| Types of investments in Malaysia |

6 simple and easy-to-understand investments

1. Gold

Gold can effectively fight inflation and is therefore considered a safe-haven asset by investors.

Gold investment can be divided into physical gold (including gold bars, gold coins and gold jewelry) and paper gold provided by banks.

Since physical gold is expensive to purchase and difficult to store, paper gold is a relatively simpler investment option.

You only need to open a gold investment account in the bank, buy and sell virtual gold according to the bank’s quotation, and earn the difference in gold prices according to the trend of international gold prices.

If you are interested in investing in paper gold, please note that only banks can sell paper gold, for instance, Public Bank, Maybank, CIMB, UOB and Kuwait Finance House.

2. Virtual Currency Investment

Cryptocurrency is a digital asset and an emerging asset class. Well-known digital currencies including Bitcoin, Ethereum, Ripple, Tether, Litecoin and more can be used for collection or trading.

There are several different ways to invest in virtual currencies. The simplest of which is to buy and hold. You just choose to buy a virtual currency and sell it when the currency value rises to the desired value.

The price fluctuations of virtual currencies are high, which is affected by supply and demand, the market environment and the currency itself.

If you want to start with this, it is recommended that you do the relevant homework beforehand and start with conservative investments.

3. Fixed Deposit

Fixed deposits can be said to be one of the most familiar financial management techniques for lazy people. It is also the most worry-free medium and long-term investment.

This is a zero-risk investment tool. Its biggest advantage is that it is highly safe and has fixed interest income and continuous income.

In addition, its method is also very simple. You only need to deposit the money in the bank and not withdraw it within the specified period. Then you will earn the interest after the expiration.

You can also choose to automatically renew the fixed deposit after it expires. The bank will automatically add your interest income to the original principal, and then invest with a higher deposit amount.

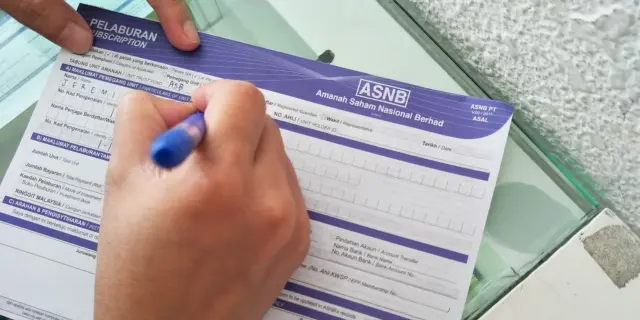

4. ASNB

ASNB Trust Fund is a fund under the Permodalan Nasional Berhad (PNB). In addition to fixed deposits, it is favored by those who seek investment stability.

The advantage of ASNB trust funds is that they can give you higher return interest, which can reach 4%-6%.

Besides, the ASNB trust funds allow for quick withdrawals, and dividend income from fixed-price funds is tax-free. If you are looking for a stable, low-risk investment that can bring more substantial returns than fixed deposits, ASNB trust fund is a good choice.

5. Exchange Traded Funds (ETFs)

An exchange-traded fund (ETF) is a fund that tracks changes in an “underlying index” and is listed and traded on a stock exchange.

ETF types include stocks, leveraged and inverse, fixed income and commodities. The advantage is that they allow you to hold different assets through one investment.

You can invest in ETFs in different industry sectors according to your preferences, such as gold, crude oil or currency ETFs.

Since ETFs track an index of a broad market, they have the effect of diversifying investment risks. Additionally, ETF investment costs are low, and it has high liquidity and transparency, making it a relatively safe investment choice.

6. Real Estate Investment

Real estate is regarded as a long-term investment. Its biggest advantage is that the value of your home will appreciate over time.

Investors can obtain stable cash flow returns by selling or renting real estate.

Since real estate is a type of investment that requires a lot of capital and knowledge, we recommend doing your homework before investing in real estate, including the economic situation, population and future development potential of the area or country.

So after knowing the above investment options, have you found your ideal investment type? You can choose several different investment allocation methods based on your salary, risk tolerance, and investment goals.

Before investing, if you are stuck in the “how much to invest” phase, don’t forget to seek investment advice from professionals to avoid losses in the future!

Consider investing in real estate! Our team of professionals will ensure you get the best out of your investment and guide you every step of the way. Leave your details below and we’ll get in touch!

[hubspot type=form portal=5699703 id=85ebae59-f425-419b-a59d-3531ad1df948]